BeMetals Completes Technical Report for the Kato Gold Project in Japan and Identifies Four High Priority Targets for Drilling

July 28, 2021

Vancouver, British Columbia – BeMetals Corp. (TSXV: BMET, OTCQB: BMTLF, Frankfurt: 1OI.F) (the “Company” or “BeMetals”) is pleased to announce the results of a technical report (the “report”) for its wholly owned Kato Project (“Kato” or the “Project”) in Japan. This report represents the first formal technical compilation and target generation report for the Project and is based upon geological work conducted by the Metals and Mining Agency of Japan (“MMAJ”) in the 1990s, and subsequent drilling between 2018-2020 by Kazan Resources prior to being acquired in April 2021 by BeMetals.

REPORT Highlights

- Four priority drill target areas identified based upon historical intersections and geological setting

- The first extensive data compilation providing rational and strong motivation for the drill targets

- Revised exploration drill hole design and equipment deployment aimed to improve penetration and core recovery of both the extensive alteration zones and higher-grade gold bearing veins

Table 1. Highlighted Historical Gold Drill Intersections at the Kato Project

| Drill Hole ID | From (m) | To (m) | Core Interval (m) | Gold Grade g/t | Company/Organisation |

| 5MAHB-2 | 314.80 | 332.30 | 17.50 | 8.15 | MMAJ |

| 7MAHB-1 | 258.85 | 277.50 | 18.65 | 5.01 | MMAJ |

| KT19-02A | 120.48 | 177.05 | 56.57 | 0.80 | Kazan Resources |

| Including | 136.95 | 164.50 | 27.55 | 1.40 | |

| Including | 150.50 | 164.50 | 14.00 | 2.10 | |

| KT20-010 | Kazan Resources | ||||

| Interval 1: | 165.30 | 224.20 | 58.90 | 0.76 | |

| Including | 167.70 | 175.10 | 7.40 | 2.99 | |

| Interval 2: | 229.80 | 232.60* | 2.80 | 3.10 |

These drill results are historical in nature. The main mineralized zone has only been completely crossed by three widely-spaced holes so the orientation and true thickness of the mineralized zone is currently not known. A nominal cut-off grade of 0.5 g/t Au has been applied to determine the boundaries of the intersections. * Drill hole ended in mineralization. See Table 3 below and QA/QC section for more information.

John Wilton, President and CEO of BeMetals stated, “This month we are pleased to have completed the first formal technical report for our Kato Gold Project in Japan which has included field validations and related drill core review. The field inspections were conducted this year. The four high priority drill targets generated from this work are very exciting and include strong geological motivation for confirmation and extensions to the high-grade, main zone, intersected by MMAJ’s historical drilling. The historical drilling also indicates broader lower-grade gold intercepts with alteration zones surrounding the high-grade veins. Table 1 above indicates selected intersections of both styles of gold mineralization.

The Kato Project is the most advanced of our five compelling gold exploration properties in the prospective Japanese epithermal gold terrane. The Kato mineralization is considered an example of a low-sulphidation epithermal system. Examples of deposits formed from this style of gold mineralization would include the world famous Hishikari Gold Mine in Kyushu, as the largest in Japan. The Julietta and Kupol deposits in Eastern Russia are also examples of this style of deposit and both projects were originally mined and or developed by Bema Gold Corp. Table 2 below provides more details of these and other examples, with a representative range of scale and grades for this deposit type.”

Mr. Tom Garagan, a BeMetals founding Director, and formerly Vice President of Exploration at Bema Gold Corp., commented, “The Kato Project was selected for its compelling geology and prospectivity with historic high-grade drill intersections within a large structurally prepared terrane. Japan has seen little exploration in recent decades and offers the potential for significant discoveries. Although at an earlier stage, Kato has similar geology to Bema Gold’s historical Julietta Mine that we explored, developed and operated in the Russian Far East.”

Mr. Wilton continued, “As a result of the extensive clay and other alteration minerals developed around the high-grade zones at Kato, which are encouraging from an overall gold mineralization potential point of view, intersecting the main target units has proved challenging in historic drilling. To address this, the Company has revised the specifications of appropriate drilling equipment and drill hole design, including the planned use of improved drill muds and a cleaning system that should enhance drilling efficiency.”

The following Table 2 illustrates some examples of gold deposits around the world, which appear to exist in an analogous geological environment as the Kato Project.

Table 2. Global Examples of Low-Sulphidation Epithermal Deposits with Ranges of Tonnage and Grades

| Deposit | Measured | Indicated | Inferred | Reference | Resource Status | |||

| Tonnage (Mt) |

Grade (g/t Au) |

Tonnage (Mt) |

Grade (g/t Au) |

Tonnage (Mt) |

Grade (g/t Au) |

|||

| Lihir* | 81 | 1.9 | 250 | 2.3 | 67 | 2.3 | Gleeson et al., 2020 | Current (1) |

| Waihi+ | — | — | 6.0 | 5.21 | 2.5 | 4.73 | Oceana Gold, 2021 | Current (2) |

| Masbate* | — | — | 136.4 | 0.81 | 31.6 | 0.79 | B2Gold Corp, 2020 | Current (3) |

| Kupol# | — | — | 6.4 | 20.33 | 4.09 | 12.45 | Crowl et al., 2005 | Historical (4) |

| Julietta# | — | — | 0.22 | 19.63 | 0.18 | 18.47 | Bema, 2005 | Historical (5) |

| Deposit | Measured | Indicated | Inferred | Reference | ||||

| Tonnage (Mst) |

Grade (oz/st Au) |

Tonnage (Mst) |

Grade (oz/st Au) |

Tonnage (Mst) |

Grade (oz/st Au) |

|||

| Grassy Mountain* | 18.2 | 0.02 | 12.7 | 0.05 | 1 | 0.04 | Raponi et al., 2020 | Current (6) |

Note: * = reported using 2014 CIM Definition Standards; # = reported using 2005 CIM Definition Standards; + reported using 2012 JORC Code. All estimates other than Grassy Mountain used metric tonnes and gram per tonne units. The Grassy Mountain estimate was reported using US Customary units of short tons and ounces per short ton.

- Lihir Operations, Aniolam Island, Papua New Guinea, NI 43-101 Technical Report: report prepared for Newcrest Mining Ltd., effective date 30 June, 2020.

- Summary Of Table 1 - 2012 JORC: Waihi Gold Mine; as at 31 December 2020” 21 February, 2021, Waihi-JORC-Table-1.pdf?v=122903

- 2020 Annual Information Form: 30 March, 2021; https://www.b2gold.com/_resources/financials/B2Gold-Annual-Information-Form-2021.pdf?v=122903

- 2005 Technical Report, Summarizing the Kupol Project Feasibility Study, Chukhotka Okrug, Russia, Bema Gold Corp.

- 2005 Bema Gold Corporation Annual Information Form

- Grassy Mountain Project, Oregon, USA, NI 43-101 Technical Report on Feasibility Study: report prepared for Paramount Gold Nevada Corp., effective date 15 September, 2020

KATO GOLD PROJECT

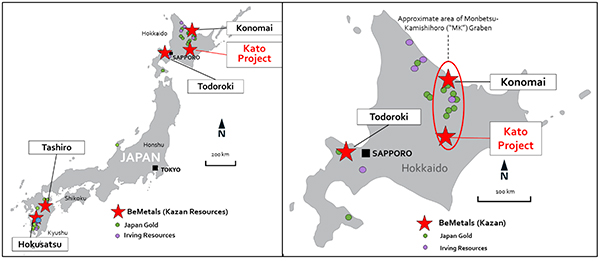

The Project is situated in a rural setting near the centre of Hokkaido, directly northwest of the town of Kamishihoro (population 4,900) and 40 kilometres north of the city of Obihiro (population 169,000). (See Figure 1). The Kato Project (historically referred to as the Seta River Prospect) is an example of a remarkably well-preserved low sulphidation epithermal gold occurrence. Outcropping of clay-altered and weakly-mineralized lake-bed sediments are evidence of a high-temperature steam-heated zone above a hydrothermal plumbing system. This mineralization style identified to date is considered an example of a low-sulphidation epithermal system. The classic example of this mineralization type in Japan is the Hishikari mine, on the island of Kyushu. Global examples of this type of mineralization include Lihir (Papua New Guinea), Kupol and Julietta (Russia), Waihi (New Zealand) and Masbate (Philippines), (See Table 2).

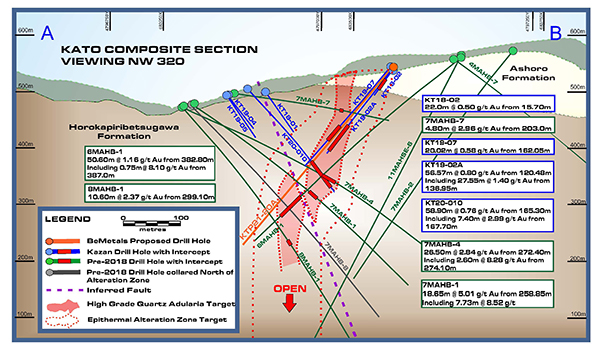

The 1990s MMAJ drilling at Kato identified a zone of higher-grade gold mineralization over approximately 170 metres of strike with an additional kilometre of potentially-favorable geology largely untested by drilling to the southeast. The gold-bearing zone is hosted in quartz–adularia vein and breccia, and occurs at depths that range from around 50–225 metres below surface (See Figure 2 and Table 1). Table 3 includes the complete set of historical drill intersection results for the Kato Project.

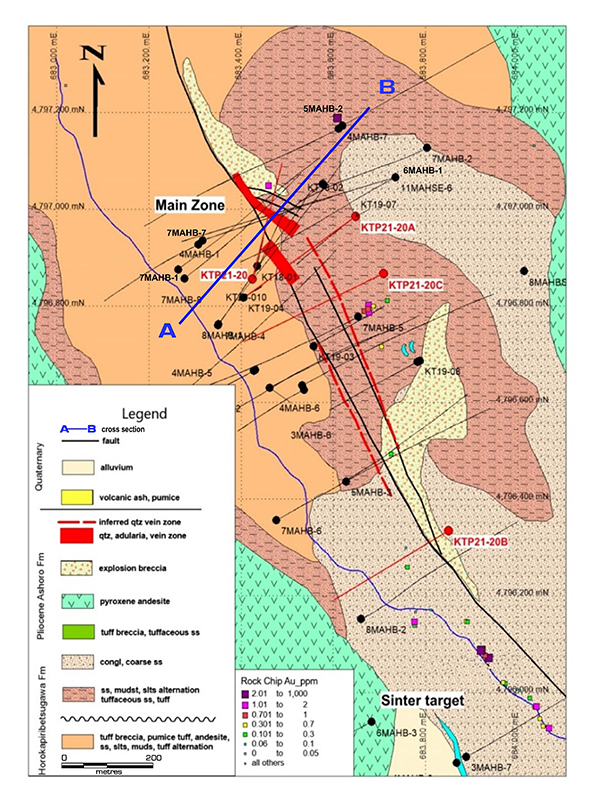

The priority drill target remains to intersect the quartz–adularia vein zone that hosts higher gold grades, and verify the grades reported in the MMAJ reports. The drilling plan will also seek to step out to the southeast along strike in a potential area of extension to the quartz–adularia vein zone and hydrothermal breccia zones that lack sufficient investigation. In addition, BeMetals plans to drill-test a sinter target in the southern extension area of the Project. The locations of the four proposed drill holes are shown in Figure 3.

Figure 1: Location of Kato Gold Project and Other BeMetals Exploration Projects in Japan

Figure 2: Composite Cross Section Showing Priority Target Zone Area and Historical Drill Hole Intersections

Figure 3: Proposed Priority Drill Holes Location Plan and Simplified Geological Map

Table 3. Kato Project: Historical Drill Hole Intersections

| Drill Hole ID | From (m) | To (m) | Core Interval (m) | Gold Grade g/t | Comments |

| 3MAHB-6 | 153.95 | 165.9 | 11.95 | 0.42 | |

| Including | 153.96 | 157.2 | 3.24 | 1.05 | |

| 3MAHB-6 | 126.25 | 127.25 | 1 | 0.66 | |

| 3MAHB-7 | 64.5 | 72.4 | 7.9 | 0.7 | |

| 4MAHB-5 | 116.8 | 119.3 | 2.5 | 13.11 | |

| 4MAHB-5 | 217.6 | 218.9 | 1.3 | 1.67 | |

| 4MAHB-6 | 175.5 | 184 | 8.5 | 3.42 | |

| 4MAHB-6 | 300.6 | 316.8 | 16.2 | 0.51 | |

| 4MAHB-6 | 320.9 | 323.8 | 2.9 | 0.77 | |

| 5MAHB-1 | 44.2 | 44.6 | 0.4 | 7.96 | |

| 5MAHB-2 | 252.9 | 266.1 | 13.2 | 0.52 | |

| Including | 258.3 | 266.1 | 7.8 | 0.6 | |

| 5MAHB-2 | 314.8 | 332.3 | 17.5 | 8.15 | |

| 5MAHB-3 | 115.15 | 115.7 | 0.55 | 3.64 | |

| 6MAHB-1 | 382.8 | 433.4 | 50.6 | 1.16 | |

| Including | 387 | 387.75 | 0.75 | 8.1 | |

| 6MAHB-2 | 250.6 | 254.5 | 3.9 | 3.22 | |

| 6MAHB-2 | 278.5 | 283 | 4.5 | 2.68 | |

| 6MAHB-3 | 277 | 283.5 | 6.5 | 0.52 | |

| 7MAHB-1 | 258.85 | 277.5 | 18.65 | 5.01 | |

| Including | 262.77 | 270.5 | 7.73 | 8.52 | |

| 7MAHB-2 | Did not intersect the primary target and was not sampled |

||||

| 7MAHB-3 | 54.4 | 55.6 | 1.2 | 3.12 | |

| 7MAHB-3 | 202.63 | 203.15 | 0.52 | 2.7 | |

| 7MAHB-3 | 206.7 | 208.15 | 1.45 | 2.17 | |

| 7MAHB-3 | 467.15 | 467.3 | 0.15 | 0.04 | |

| 7MAHB-4 | 266.65 | 269.3 | 2.65 | 3.71 | |

| 7MAHB-4 | 272.4 | 298.9 | 26.5 | 2.84 | |

| Including | 274.1 | 276.7 | 2.6 | 8.28 | |

| 7MAHB-5 | 275.28 | 275.75 | 0.47 | 60.62 | |

| 7MAHB-5 | 290.75 | 291.19 | 0.44 | 4.69 | |

| 7MAHB-6 | 90.3 | 93.75 | 3.45 | 1.94 | |

| 7MAHB-6 | 345.2 | 377.3 | 32.1 | 0.64 | |

| 7MAHB-7 | 203 | 207.8 | 4.8 | 2.96 | |

| 7MAHB-7 | 226.3 | 226.6 | 0.3 | 6.4 | |

| 7MAHB-8 | 418.35 | 419.65 | 1.3 | 3.08 | |

| 8MAHB-1 | 299.1 | 309.7 | 10.6 | 2.37 | |

| 8MAHB-2 | 141.4 | 152.35 | 10.95 | 1.07 | |

| KT18-01 | Hole did not reach primary target | ||||

| KT18-2 | 15.7 | 37.7 | 22 | 0.5 | Hole did not reach primary target |

| KT19-02A | 120.48 | 177.05 | 56.57 | 0.8 | Hole did not reach primary target |

| Including | 136.95 | 164.5 | 27.55 | 1.4 | |

| Including | 150.5 | 164.5 | 14 | 2.1 | |

| KT19-03 | 128.6 | 138.17 | 9.57 | 0.64 | |

| KT19-03 | 168.87 | 176.16 | 7.29 | 0.22 | |

| KT19-04 | Hole did not reach primary target | ||||

| KT19-05 | Hole did not reach primary target | ||||

| KT19-06 | 121.5 | 122.2 | 0.7 | 1.12 | |

| KT19-07 | 162.05 | 182.07 | 20.02 | 0.58 | Hole did not reach primary target |

| Including | 165.3 | 169.37 | 4.07 | 1.05 | |

| KT19-07 | 242.97 | 243.27* | 0.3 | 21.1 | *0.33m from end of hole depth |

| KT19-08 | Hole did not reach primary target | ||||

| KT20-010 | 165.3 | 224.2 | 58.9 | 0.76 | |

| Including | 167.7 | 175.1 | 7.4 | 2.99 | |

| KT20-010 | 229.8 | 232.6 | 2.8 | 3.1 |

These drill results are historical in nature. MAHB series drill holes completed by MMAJ and KT series drill holes completed by Kazan Resources. BeMetals has not undertaken any independent investigation of the sampling nor has it independently analyzed the results of the historical exploration work in order to verify the results. BeMetals considers these historical drill results relevant as the Company will use these data as a guide to plan future exploration programs. The Company also considers the data to be reliable for these purposes however the Company's future exploration work will include verification of the data through drilling. *Drill hole ended in mineralization. The main mineralized zone has only been completely crossed by three widely-spaced holes so the orientation and true thickness of the mineralized zone is currently not known. A nominal cut-off grade of 0.5 g/t Au has been applied to determine the boundaries of the intersections.

Table 4. Drill Hole, Azimuth, Dip, EOH Depth, Collar Co-ordinates of Historical Core Drill Holes

| Drill Hole ID | WGS84 East | WGS84 North | WGS84 Elevation | Azimuth | Dip | End of Hole Depth |

| 3MAHB-6 | 683532.57 | 4796635.41 | 470.54 | 63 | -20 | 501.0 |

| 3MAHB-7 | 683888.19 | 4795867.08 | 470.46 | 63 | -30 | 500.0 |

| 4MAHB-5 | 683430.24 | 4796667.42 | 463.9 | 243 | -42 | 500.7 |

| 4MAHB-6 | 683461.67 | 4796630.82 | 461.09 | 63 | -43 | 501.0 |

| 5MAHB-1 | 683299.86 | 4796539.87 | 472.38 | 63 | -43 | 700.2 |

| 5MAHB-2 | 683611.39 | 4797167.28 | 557.75 | 243 | -38 | 600.1 |

| 5MAHB-3 | 683627.23 | 4796437.06 | 454.32 | 63 | -45 | 501.1 |

| 6MAHB-1 | 683734.58 | 4797066.17 | 560.76 | 243 | -37 | 500.1 |

| 6MAHB-2 | 683114.34 | 4797042.14 | 489.11 | 63 | -24 | 501.0 |

| 6MAHB-3 | 683682.56 | 4795939.28 | 476.19 | 243 | -25 | 501.5 |

| 7MAHB-1 | 683263.39 | 4796875.81 | 476.87 | 055 | -33 | 500.1 |

| 7MAHB-2 | 683802.56 | 4797127.14 | 571.93 | 243 | -49 | 503.0 |

| 7MAHB-3 | 683227.27 | 4796582.58 | 482.99 | 52 | -39 | 670.7 |

| 7MAHB-4 | 683350.57 | 4796762.05 | 469.95 | 38 | -25 | 501.5 |

| 7MAHB-5 | 683653.30 | 4796777.37 | 518.75 | 243 | -39 | 600.0 |

| 7MAHB-6 | 683476.25 | 4796356.74 | 452.86 | 63 | -36 | 600.4 |

| 7MAHB-7 | 683316.16 | 4796935.36 | 496.65 | 72 | -10 | 300.0 |

| 7MAHB-8 | 683277.21 | 4796856.96 | 476.24 | 53 | -45 | 502.5 |

| 8MAHB-1 | 683349.49 | 4796759.91 | 469.95 | 38 | -50 | 600.2 |

| 8MAHB-2 | 683659.31 | 4796152.57 | 458.32 | 65 | -30 | 451.0 |

| KT18-02 | 683578.44 | 4797050.74 | 535.71 | 245 | -52 | 51.15 |

| KT19-02A | 683576.81 | 4797052.26 | 535.48 | 245 | -52 | 183.0 |

| KT19-03 | 683556.97 | 4796716.98 | 492.38 | 63 | -45 | 256.3 |

| KT19-06 | 683535.84 | 4796626.27 | 469.88 | 243 | -45 | 79.4 |

| KT19-07 | 683647.93 | 4796985.70 | 552.09 | 235 | -50 | 243.6 |

| KT19-08 | 683787.00 | 4796687.00 | 508.00 | 243 | -45 | 68.7 |

| KT20-010 | 683424.00 | 4796856.00 | 497.00 | 030 | -45 | 232.6 |

QUALITY ASSURANCE AND QUALITY CONTROL

A site visit was conducted by Mr. Luke Viljoen from 27–31 January, 2021. He inspected the Project area, reviewed local infrastructure, geological characteristics, verified grab sample locations, inspected drill core and drilling sites, reviewed geological data collection and sample preparation procedures, discussed historical activities on the properties with BeMetals representatives, and collected a number of verification samples of outcrop and drill core from the Kato area. Verification performed on the Kazan Resources drilling included checks of original paper log data against digitally uploaded data, and review of QA/QC data. Data are acceptable for early-stage exploration vectoring.

TECHNICAL REPORT

The Qualified Persons preparing the technical report are Mr Tom Garagan, P.Geo., and Mr. Luke Viljoen, Pr. Sci. Nat. The report will be filed with SEDAR and posted on the Company’s website.

ABOUT BEMETALS CORP.

BeMetals is a precious and base metals exploration and development company focused on becoming a leading metal producer through the acquisition of quality exploration, development and potentially production stage projects. The Company has recently established itself in the gold sector with the acquisition of certain wholly owned exploration projects in Japan. BeMetals is also progressing both its advanced high-grade, zinc-silver-gold-copper polymetallic underground exploration at the South Mountain Project in Idaho through a preliminary economic assessment, and its tier-one targeted, Pangeni Copper Exploration Project in Zambia. Guiding and leading BeMetals’ growth strategy is a strong board and management team, founders and significant shareholders of the Company, who have an extensive proven record of delivering considerable value in the mining sector through the discovery, construction and operation of mines around the world.

The technical information in this news release for BeMetals has been reviewed and approved by John Wilton, CGeol FGS, CEO and President of BeMetals, and a “Qualified Person” as defined under National Instrument 43-101.

ON BEHALF OF BEMETALS CORP.

“John Wilton”

John Wilton

President, CEO and Director

For further information about BeMetals please visit our website at bemetalscorp.com and sign-up to our email list to receive timely updates, or contact:

Derek Iwanaka

Vice President, Investor Relations & Corporate Development

Telephone: 604-609-6141

Email: diwanaka@bemetalscorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release

Cautionary Note Regarding Forward-Looking Statements

This news release contains "forward-looking statements" and “forward looking information” (as defined under applicable securities laws), based on management’s best estimates, assumptions and current expectations. Such statements include but are not limited to, statements with respect to future exploration, development and advancement of the South Mountain Project, the Pangeni project and the Japan properties, and the acquisition of additional base and/or precious metal projects. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as "expects", "expected", "budgeted", "forecasts", "anticipates", "plans", "anticipates", "believes", "intends", "estimates", "projects", "aims", "potential", "goal", "objective", "prospective", and similar expressions, or that events or conditions "will", "would", "may", "can", "could" or "should" occur. These statements should not be read as guarantees of future performance or results. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from those expressed or implied by such statements, including but not limited to: the actual results of exploration activities, the availability of financing and/or cash flow to fund the current and future plans and expenditures, the ability of the Company to satisfy the conditions of the option agreements for the South Mountain Project and/or the Pangeni Project, and changes in the world commodity markets or equity markets. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The forward-looking statements and forward looking information are made as of the date hereof and are qualified in their entirety by this cautionary statement. The Company disclaims any obligation to revise or update any such factors or to publicly announce the result of any revisions to any forward-looking statements or forward looking information contained herein to reflect future results, events or developments, except as require by law. Accordingly, readers should not place undue reliance on forward-looking statements and information. Please refer to the Company’s most recent filings under its profile at www.sedar.com for further information respecting the risks affecting the Company and its business.